By Peter Herbaly, Global Resident Engineering Director; Continental Europe Sales Vice President, TRIGO Group

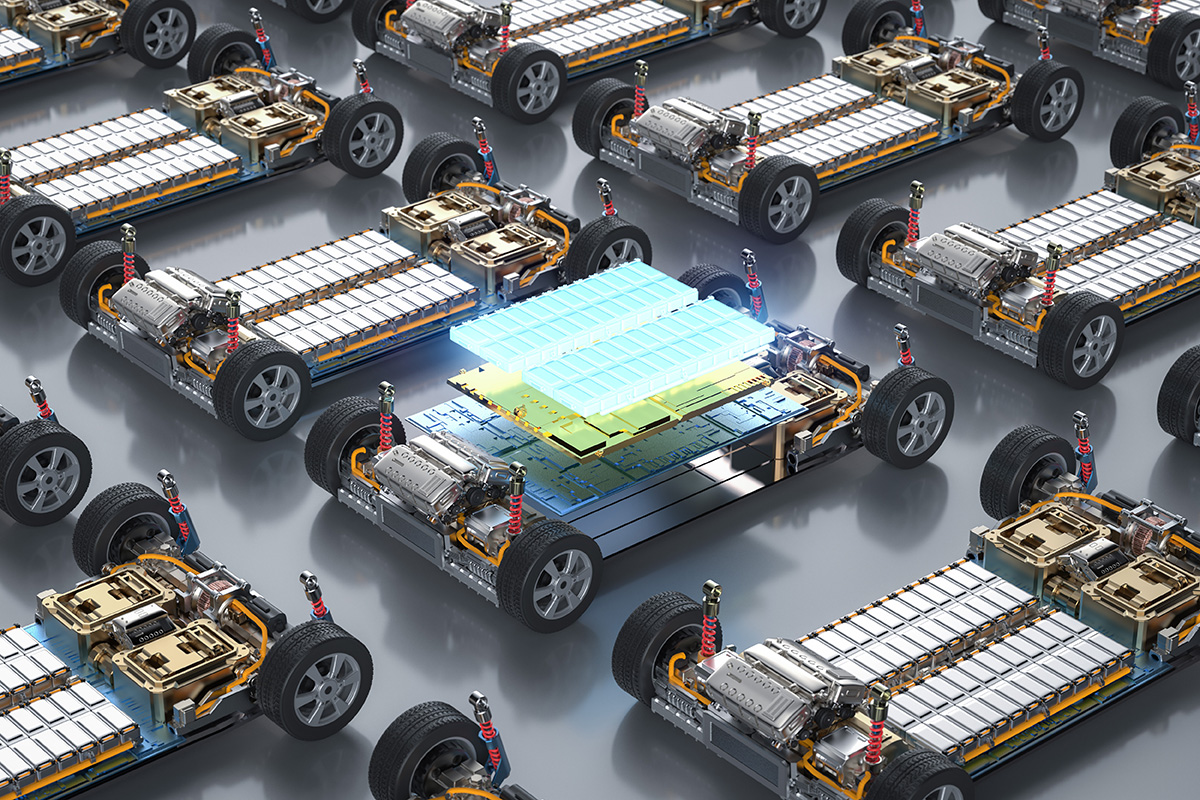

After the first wave of Chinese Battery Gigafactories coming to Europe, the market faces the arrival of Tier 2 and 3 Chinese Gigafactory suppliers. Due to financial reasons, Gigafactories seem like the natural next step in the supply chain process. Bridging the knowledge gap between Asian Suppliers and European automotive industry standards and requirements pose significant challenges. This is particularly true in the case of supplying essential components and raw materials for electric battery manufacturing. What expectations must Asian suppliers meet in order to satisfy the expanding European electric battery automotive market where Gigafactories are proliferating?

Asian Suppliers Increasing Presence in Europe and closer to the supply chain

Chemicals, mechanical parts, structural components, electrode rolls...these are all products serving as raw materials for electric battery manufacturing. Suppliers of these components and materials in Asia have recently been strategically relocating closer to their clients operating "Gigafactories" in Europe. The rapidly accelerating European marketplace has prompted Asian suppliers to establish a presence in Europe, thereby increasing the total number of suppliers in the European community. Asian suppliers make up two-thirds of Gigafactory suppliers located in Europe. The remaining one-third of suppliers have opted to remain in Asia. This choice reflects the commitment of Asian companies to closely align with automotive manufacturers in this rapidly growing market.

It seems that this market trend is global, since the same dynamic that is observed in Hungary can also be observed in Mexico and Morocco, where Asian suppliers have also moved their supply chain to be closer to OEMs.

Often, manufacturers and equipment suppliers must provide extensive support to Asian suppliers in order to compensate for the lack of knowledge of local logistical requirements. They must address both maritime and land-based challenges in order to serve their "Gigafactory" clients in Europe. "Overall, Asian suppliers are not accustomed to working with Gigafactories in Europe, and when they do establish themselves there, they need support because they do not have a good grasp of the logistical, regulatory and environmental specificities of the European Union," analyzes Hans Gerd Düsterwald, EVP Continental Europe at TRIGO Group.

Asian suppliers tend to enter Europe from the East, notably through Hungary, for two reasons. The first one is geographical, as Hungary is considered by the Chinese as the gateway to the "new Silk Roads" in Europe. This ambitious project includes the construction of a railway line between Budapest and Belgrade. This line will allow trains filled with Chinese goods from the Greek port of Piraeus to Central Europe. The second reason is political and can be explained by the proximity between the Hungarian and Chinese governments. This proximity results in numerous local subsidies and tax incentives to encourage the installation of Asian battery suppliers in Hungarian territory. Hungary is a promising logistics hub for the Asia/Europe connection.

What requirements will European manufacturers place on Chinese suppliers in order to meet the supply chain demands of the European electric automotive industry?

Facing an increase of new suppliers involved in the value chain, although some of these controls are internalized, Gigafactories will quickly find themselves unable to independently conduct supplier audits and will face a strong need to outsource them. This presents an opportunity for industrial quality service providers with teams dedicated to training, consulting, and auditing activities in the electric automotive sector. TRIGO, through its "Advanced Services" division, provides technical support, training, and auditing to most automotive manufacturers' suppliers. This expertise ranges from technical analysis of quality and production problems, through the management and support of non-conformities, to preparing suppliers for certification in quality standards demanded by the global automotive sector.

"Whether its manufacturers, automotive equipment suppliers, or suppliers, the entire sector is on a learning curve to secure both the production line and supplies. Gigafactories do not yet have enough experience to assess the reliability of one supplier over another. The only valid performance indicators at this stage concern the non-conformity rate and the production line yield," said Hans Gerd Düsterwald at TRIGO Group.

So how do you ensure the viability of the relationship with suppliers in the electric automotive sector? First, by conducting "supply chain," "capacity” and "quality" audits. In addition, by imposing a policy of transparency and responsiveness. In concrete terms, it is about ensuring that the supplier has anticipated the cost of entry to survive in this highly competitive sector. This suggests that suppliers ensure that they have a strong enough financial position to consider collaboration with Gigafactories.

With exponential sector growth and the increase of Gigafactories throughout Europe, securing the supply chain is shaping up to be the next crucial challenge and a negotiation lever in the relationship between automotive manufacturers and suppliers. Indeed, "the establishment of performance and trust indicators will be essential to manage the viability of the relationship with Asian suppliers and secure the procurement strategy and logistics of Gigafactories," concludes Hans Gerd Düsterwald.