Electric vehicles are becoming the new standard to usher in the energy transition for the global automotive market. In 2023, the French Automotive Platform (PFA) reported that 26% of new vehicle registrations in France were electric, compared with 21.6% in 2022. That amounts to 1,774,729 new electric cars on the road last year. However, the rapid electrification of the market poses this challenge: how to optimize the life cycle of batteries. With EVs having about a ten-year lifespan, manufacturers are seeking insights into the end-of-life condition of their components.

This uncertainty, coupled with the diversity of battery technologies, means that we still have only a limited amount of detailed knowledge. So how can we anticipate the end of a battery's life cycle to limit the waste of rare metals such as zinc, cobalt and lithium? Here are three ways on how Europe can expand the life of EV batteries.

OEMs and legislators: a shared vision of European independence

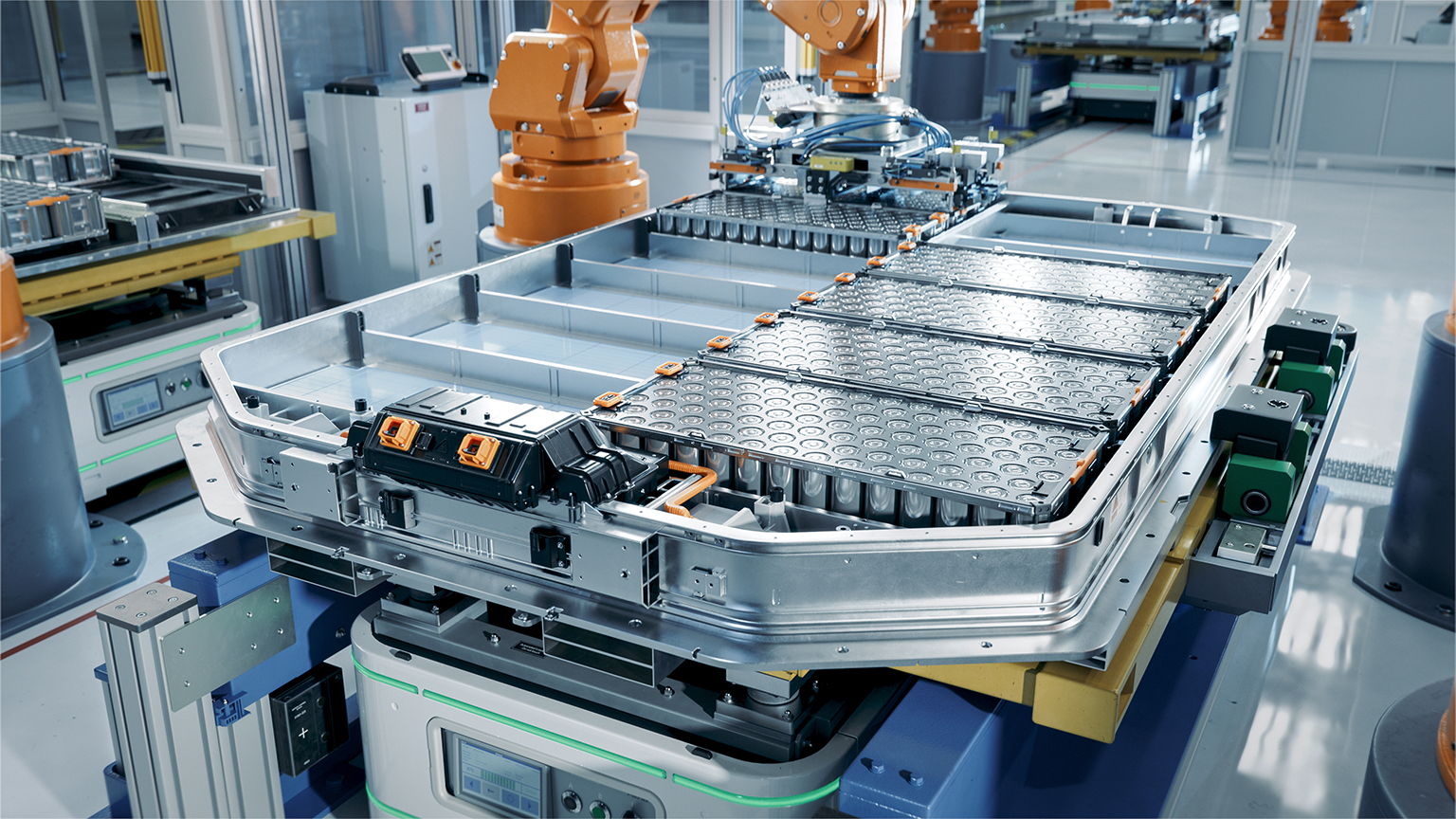

The scarcity of raw materials is prompting equipment manufacturers to focus on how to extend battery life. A wise choice, since the supply of these resources is the first link in the EV production chain. Each automaker is doubling down to secure its supply chain while strengthening its operational capacities in a highly fragmented market.

In this respect, the intervention of public authorities within Europe’s auto industry is key. By stepping up their action, European governments can stimulate the construction of infrastructures conducive to the development of this circular economy. This, in turn, creates an attractive environment for the emergence of a dynamic, private ecosystem, which will be sustained over the long term.

In July 2023, the European Union adopted a regulation to facilitate battery recycling. This announcement heralds the development of a European recycling market for battery components. According to the EU, more than 2.2 billion euros are invested each year to process around 570,000 tons of battery materials. On top of that, market players will need to invest an additional 7 billion euros to process all recyclable lithium battery materials by 2035.

The use of “passports” to track batteries

The repair and reconditioning of batteries is designed to offer transparency on the fate of replaced components and parts. This also applies to components that are no longer suitable for remarketing and end up in the scrap heap. Players in the auto sector, grouped under the Global Battery Alliance (GBA), have announced all electric batteries will have a fully digitized “passport.” Aimed at guaranteeing environmental, social and technical responsibility, all batteries will be equipped with a QR code offering traceability throughout their life cycle, and in particular their end-of-life, which until now has not been transparent.

Although this is an impressive move, the framework is not ambitious enough. Given the stakes involved, Europe will not emerge victorious in the absence of a more substantial program. To become a leader in the circular economy, Europe needs to structure this new activity to be more competitive with other countries. This is the case in China, where the circular economy was structured in parallel with the development of EVs nearly ten years ago. But there still needs to be a pool of skilled talent in fields such as electrical engineering and chemistry.

The circular economy as a lever for reindustrializing Europe

The auto industry are looking for cutting-edge engineering expertise to meet the challenges posed by the growth of the circular economy. The shortage of talent in the EV sector means that this search has to be outsourced to specialized service providers.

When it comes to reconditioning batteries*, mastering certain processes is essential, as these are often complex and dangerous devices due to the high risk of flammability. Industrial quality service providers have in-depth technical expertise in the inspection, diagnosis, repair, reconditioning and recycling of batteries. This enables them to guarantee the reliability of their services throughout the value chain.

As a result, automakers have access to specialized infrastructures and a pool of qualified technicians. This agility gives them a considerable advantage in the war for talent as the industrial sector copes with the shortage in manpower.

As Europe forges ahead with its reindustrialization, the end-of-life management of electric batteries appears to be a strategic issue: decarbonizing an industry while limiting the waste of rare materials. To avoid being sidelined, Europe has every interest in speeding up its efforts to catch up with China.

China’s ban on the export of rare-earth mining technologies is a step in this direction. What impact will this announcement have on the global automotive production chain, placing the issue of technological independence at the heart of the French and European economic agendas?

Feel free to tell us in the comments.

*TRIGO Group inspects, diagnoses and repairs electric batteries to give them a second life. It provides these services either in its own battery clinics or directly at the customer's site with TRIGO analysts.